How Much Money Did You Earn – Really! Try Normalization

Why Normalization Matters

Normalization, sometimes referred to as recasting, involves adjusting your financial statements to reflect the true earning potential of your business.

This process is crucial for Business Valuation because:

1. Presenting a Realistic Earnings Picture: By normalizing, you adjust for one-time expenses or atypical revenues, providing a more accurate view of your business’s profitability.

2. Comparative Analysis: When using the market approach, normalized earnings ensure a fair comparison with other businesses in your industry, aiding in a more accurate business valuation.

3. Identifying Value Drivers: Normalization highlights the strengths and weaknesses in your business, allowing you to address areas that may devalue your business.

4. Identifying Anomalies: Look for irregularities in your financial records, such as non-recurring expenses or unusual income, and adjust them accordingly.

5. Considering Industry Standards: Understand the standard practices in your industry and how they affect financial reporting.

6. Using Spreadsheets for Clarity: Implementing normalization on spreadsheets can simplify the process. Create columns for adjustments next to your original figures for a clear before-and-after comparison.

7. Seeking Professional Insight: If you’re new to normalization, consider consulting with a financial advisor who can provide tailored guidance for your business.

Example of Normalization

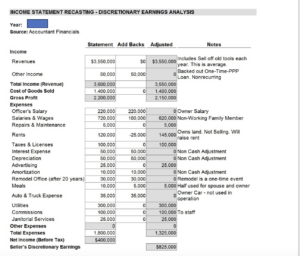

Consider a business owner who generated nearly $3.5 million in annual revenues and received a one-time $50,000 government grant. This amount is deducted from the cash flow as it’s not a regular occurrence. Such adjustments are essential for a realistic business valuation.

In addition to the net income of $400,000, other elements affect the business valuation. For instance, the owner paid herself $220,000 annually and her spouse $100,000, even though the spouse hasn’t worked in the business for years.

Moreover, the owner plans to retain the real estate post-sale and decided to increase the rent by $25,000 annually, reflecting as a negative cash flow adjustment. Non-cash items like amortization and depreciation, which don’t require cash outflow, are added back.

Interest expenses are also added back, as they will no longer exist once the business is sold. Additionally, the owner made a $30,000 adjustment for a one-time business remodel, adding this back to the owner’s benefit for an accurate business valuation.

Practical Adjustments for Proper Business Valuation

It’s crucial to understand how various adjustments can impact your business valuation. For example:

- Owner’s Compensation: Adjustments might include owner’s salary and any salaries paid to family members who aren’t actively working in the business.

- Rent Adjustments: If the owner owns the real estate, adjustments may include changes in rent post-sale.

- Non-Cash Items: Depreciation and amortization are non-cash expenses and should be added back to the cash flow.

- Interest: Existing interest expenses are added back, as they won’t transfer to the new owner.

- One-Time Expenses: Large, non-recurring expenses, such as a significant remodel, should be adjusted.

Personal Expenses

Personal expenses that don’t contribute to the business operations, like family meals or personal automobile payments, should also be added back. For instance, about half of the meals expensed were personal, while the other half was used for client meetings and employee celebrations. The latter is essential for maintaining business relations and should not be added back.

Conclusion

Normalization, or recasting, is about adjusting financial statements to accurately reflect a business’s true earning potential. This is essential for business owners asking, “What is my business worth?” By implementing these adjustments, you can present a more appealing and profitable picture to potential buyers or investors. Legacy Venture Group’s Tampa Business Broker can assist you through this process, ensuring your business valuation reflects its real potential.

Remember, the value of your business lies not just in its current earnings but in its potential. By effectively normalizing your financial documents, you provide a clearer, more attractive picture to potential buyers, ultimately enhancing your business’s worth. If you’re unsure about the process, Legacy Venture Group’s Tampa Business Broker is here to help. Whether it’s understanding industry standards or identifying value drivers, our expertise ensures your business valuation is accurate and appealing to prospective buyers.

Are You Asking: “What is my business worth?”

This is why business owners frequently ask, “What is my business worth?” With proper normalization, your financial statements will provide the answer, highlighting the true potential and profitability of your business. Legacy Venture Group’s Tampa Business Broker can guide you through this intricate process, ensuring your business valuation is both accurate and optimized for the market.

Asking yourself “When should I sell my business?”

One of the super powers that legacy venture group has over many M&A advisers around the United States and around the world, as well as other business brokers around the United States, and around the world is a commitment to working with other intermediaries in order to find the right buyer for our clients businesses.

The prevailing policy, amongst most intermediaries around the world, and around the United States, is to hold onto a listing, and be the only ones that find the prospective buyer. When there’s nearly 5000 professional business intermediaries around the planet, those who are professional, maintain confidentiality, and respect clients or individuals that we are willing to share our success fees with in order to serve our clients best.

That means we work with individuals from brokerage firms like TransWorld, advisors, Sunbelt business brokers, FirstChoice, business brokers, Viking, Bizbuysell, Business, Brokers of Florida, VR, Business, Brokers, Murphy Business Brokers and more.

Over the years, we’ve worked with a wide variety of businesses. We love construction related businesses. Heating and air-conditioning or HVAC companies, roofing companies, electrical, contractors, plumbing, companies, urgent, care, businesses, dental practices, online, distribution companies, manufacturing companies, restaurants, bars, and more. Although our group of brokers are based in Tampa, Florida, we’ve done business in Naples, Florida, Fort Myers, Florida Boca Raton, Sarasota, Bradington, Lakeland, St. Petersburg, Clearwater, Orlando, Miami, Vero beach, Jacksonville, and more